Many investors, old and new alike, suggest that you stay away from bubbles. And if you have long-term capital appreciation interests in mind, then it is definitely advisable to avoid them. But if you are willing to trade on the short-term or take a short position, bubbles can offer a lot of opportunities to make money.

We’ve written about hedging in a bubble and protecting yourself and your long-term assets – Uncertain Volatile Times Call for Certain Investment and Hedging Strategies in the Stock Markets. In this article, let’s look at how bubbles offer opportunities to make money, not just exercises in managing risk. Later stages in a bubble tend to be very volatile, and so you should realise that you are taking high risks.

There are two kinds of bubbles:

- Ones that are rapidly expanding and easily identifiable as bubbles; and

- Ones that have grown over time, are trading “sideways”, and have no real fundamental reason to demand the current market valuation.

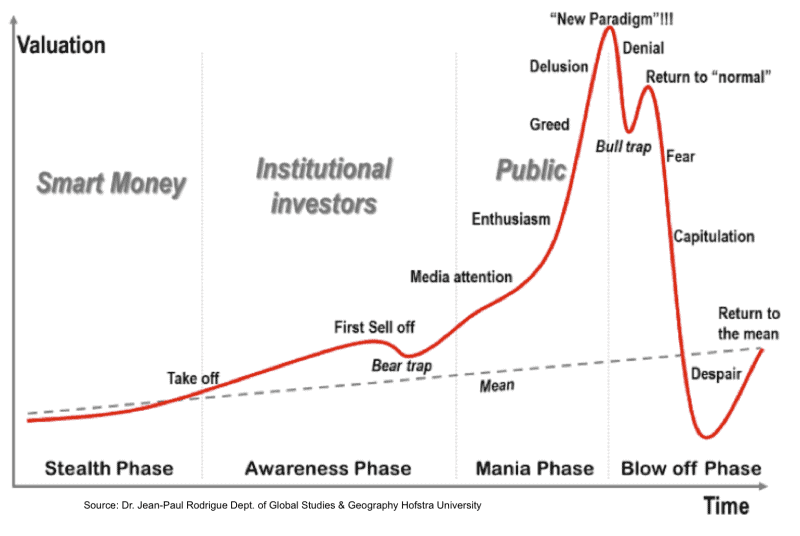

Below is the anatomy of a bubble:

1. The Rapidly Inflating Bubble

This one is relatively easy to identify and make money. Finding it might be just simply looking at social media or talking to friends. If your friend, who has never had an interest in technology, is suddenly spouting the merits of some new technology, it’s likely you’re witnessing the hysteria portion of the graph. If the general public is talking about it, it isn’t too late to make some last-minute money. But you need to keep your outlook very short-term and use protection tools.

Most of us will never enter an asset in the stealth phase. There is so much information available today, and most of us are not actively seeking out such stealth information. It may be public, but it is not easy to find. A search for “stealth information” is not exactly informative.

In the stealth phase, there isn’t actually a bubble formed yet. It is a bona fide good investment at that point because the valuations are not extraordinary. Getting in during the stealth phase, though, as mentioned, is unlikely. The awareness phase, however, is much more likely. If only a single friend has mentioned it, and there are not thousands of generic articles on the subject easily searchable, you are probably in the beginnings of the awareness phase. Entering here affords more opportunity to gain, but it’s still advisable to use hedging techniques.

If everyone you know, plus the media, is talking about it, it’s too late. You can try to enter for short-term gains, but this is the hysteria phase, and it will end abruptly. The key here is “abrupt”. Since bubbles tend to burst suddenly (rather than slowly deflate), if you catch the upswing at the wrong time, you will become a victim of the crushing downswing. If you have the courage to enter here, you need to make sure you stay well-hedged.

If you are dealing with traditional financial instruments, such as equity, you can easily hedge your bets. As mentioned in our risk management article on bubbles, options are a cheap form of insurance. You can always extend your option hedge coverage past your planned exit timeframe to ensure you maximize your earnings. Fortunately for contrarians, during rapidly increasing price markets, out-of-the-money put options will be cheap. As the price rises, people will be less inclined to sell near-the-money and out-of-the-money options, as the price is rising so rapidly, no one expects to exercise them.

For example, if the current price is $150 and many analysts are predicting targets of $250, but you predict it will drop to $50, you can easily buy $100 puts for cheap. Everyone wants $160 puts, not far out-of-the-money puts. Even after incorporating the time value of money, if people have a strong inclination towards the bubble, you can buy the $100s easily. This in itself is a contrarian strategy, but you can even trade stock on the way up.

If you are wrong, you lose a few dollars on the options that expire worthless. You might make gains on the stock if you bought it at $150 and sold at $200. If you’re right, and you enter at $150 and exit at $125 (on the way down to $50), you still make a $25 profit per hedged share ($125-$150 = -$25 on the stock purchase, but $100-$50 = +$50 on the option trade). This example completely ignores the option costs, which are not negligible but hopefully very low. The only issue might be finding put options that are very far out-of-the-money: no one is writing them because almost no one will buy them.

2. The Long-Term Bubble

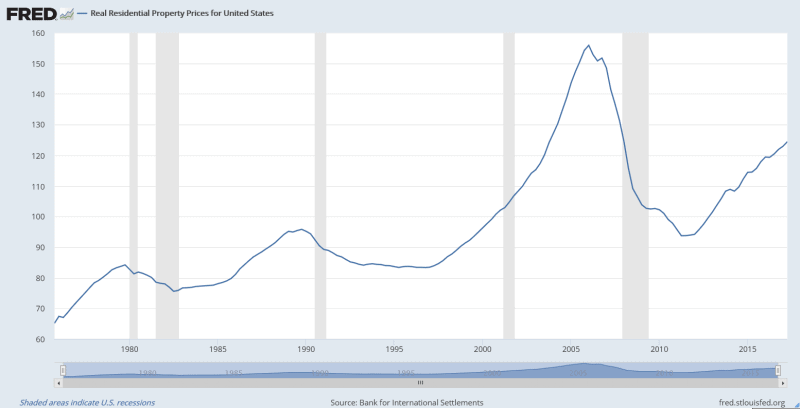

Other bubbles are not so obvious. Sometimes the price rises continuously but slowly over a long period of time. This gives investors a false sense of security because the price increase seems stable. After all, if the price continues to rise over a long period, there must be seasoned investors who are verifying the increase. Unfortunately, seasoned and institutional investors also miss bubbles. One glaring example is the housing market bubble that subsequently led to the crash of 2007-2008.

The bubble slowly inflated over a decade. The slow rise in prices from 1997 to 2002 might not have seemed like a bubble at all. It was in line with previous new highs, and the continued upward trend seemed like a reconfirmation that the market was not in a bubble but reaching a new normal.

However, looking at this chart from the St. Louis Federal Reserve, we can see the telltale sign of a bubble. The uptrend accelerates just before the bubble bursts. People are in a euphoric state, and they believe the price cannot go down – or at least it cannot go lower than where they buy in. Thus everyone wanted to buy houses with big mortgages because they could sell it the next year for profit. We can see an inflexion point in 2003, where the already unbelievable growth accelerates even more.

Because long-term bubbles are hard to identify, how can you make money on them? The well-known adage in finance states “the markets can remain irrational longer than you can remain solvent”. This is especially true with the long-term bubbles. For this reason, even if your analysis is correct, you may not be able to make money quickly – or at all, depending on the level of irrationality in the market. For this reason, simply shorting is not a good idea. If the bubble rises past your margin call limit and you cannot deposit enough, you will be forced to take the loss. Even if the bubble bursts the following day, you still finalized the loss. Furthermore, you have to pay interest on short positions, as they are technically borrowed. This means you will be paying interest until the bubble bursts, which could be a long time. You would also risk dividend payments

Long-term options and futures certainly exist, but due to the time value of money, they might be pretty expensive. There is actually a term for them: LEAPS (Long-Term Equity AnticiPation Securities). You can develop a structured options strategy, but if the bubble slowly deflates, you won’t be able to generate as much profit – each time you roll over your portfolio, the lower prices will already be baked into the new options you restructure with. Constantly restructuring will erode profits via transaction costs and fees.

Other Strategies

ETFs

ETFs are quite useful for both long and short-term bubbles. They tend to have very low expense ratios, and certainly below options restructuring and short selling interest rates. That means you can hold them long-term, longer than the markets remain irrational. Furthermore, because you buy ETFs like regular equity, your liabilities are limited. While this is true when buying options, it is not true with shorting. You can’t trigger a margin call with an ETF, either, as long as you don’t buy it on margin. You can, however, gain extra exposure with leveraged ETFs, which is useful for both sideways trading and when the bubble bursts (or deflates).

If you believe an entire industry is in a bubble, ETFs can also help you gain exposure to the entire market or industry. One risk in contrarian bubble investing is choosing the wrong company. Even if the industry crashes, there may be one or two companies that emerge relatively unscathed. If you happen to choose them as your contrarian investment, you will miss the profits from shorting the others. Using ETFs, you can expose yourself to the entire breadth of the industry.

Up and Out Technique

One way to make money in a rising bubble is to join the party. Using trailing stop loss trades, you can follow the price up and jump out when it starts to fall. Assuming the “fall” is not a “plummet” and the market doesn’t skip right over your stop loss. If you think you can enter long enough before the peak to see some price gains, trailing stops let you enter the security and forget about it. Trailing by a couple percentage points will lock in almost all of your gains without you needing to check the performance every few hours.

One caveat is to not make your stops too tight in a volatile market. Only use tight stops if you are confident the price will not whipsaw around any resistance levels. Otherwise, your stop losses will trigger too often, possibly losing you money over time.

Market Psychology

Psychological finance and the herd mentality are integral parts of examining an overvalued company, industry, or asset. Following the trend is a reliable method to generate consistent profits. With so many market participants, many of the algorithmic traders looking specifically for patterns, it is completely reasonable to implement aspects of psychological finance. If the numbers diverge from fundamental valuations, as long as you follow the trend carefully, you will record profits. Even if the numbers completely decouple from the fundamental valuation, which is often the case in a bubble, being contrarian is not always as profitable as being part of the herd yourself.

How to Avoid Losses

The first piece of advice to avoid losses is rushed investing. Especially when faced with the rapidly-inflating bubble scenario, many investors suffer from the Fear of Missing Out (FOMO). FOMO seems to be infecting the ICO and cryptocurrency market at the moment. It is so pervasive in that asset class that many people buy into projects with single-page white papers and almost no understanding of the background – or interest in whether it works.

A similar situation caused the buildup of subprime mortgages. The institutional investors suffered from FOMO, so they encouraged NINA borrowers (no income, no assets), and NINA borrowers (among more financially stable individuals) rushed to purchase homes everywhere, including in far-flung, unfinished developments, on the promise that the price would only rise. Lacking the fundamentals, many properties suffered huge losses following the 2008 meltdown.

If you suspect or can clearly identify a bubble, there is no issue with investing, even in line with the current market trends. You should maintain hedges, either in the form of inverse ETFs and options or, at the very least, by implementing stop loss trades.

Traps and Risks

In a bubble, there is a risk of being complacent and believing that the price will go in one direction and there is “no way” the price will drop (this is precisely the prevalent attitude just before the Subprime Crisis). Here are a couple of things to watch out for:

Buying the Dip

Some people like to “buy the dip”, or purchase shares after noticeable price declines. These declines are often short-term corrections, and hence the price rises from the dip’s low to continue achieving new highs, assuming the prevailing trend is upwards. This works well in a bubble – before it bursts. Small corrections may make the trader complacent in the bubble because the short-selling naysayers only eke out small gains while the long buyers are raking in cash. Clearly, the trend is in favour of higher prices, and the correction losses are quickly recouped. Thus the market must believe high prices are the true prices, and this is not a bubble.

This trading technique works until the market realizes its folly and the price crashes. Don’t let small and continuous price gains blunt your vigilance. If your original intention was short-term trading in a bubble, stick with the plan unless several fundamental changes have occurred. Since a crash generally involves a large and immediate price decline, if you “bought the dip” at £250, £280, and £290, but the price plummets from £300 to £225 in a day, you’ve already lost a lot of capital.

Stop losses are not guarantors of safety

Furthermore, don’t rely solely on stop-losses as hedges, especially if you have a lot of capital at play. I recommend stop losses to help with gain management, but stop-loss orders become market orders once they’re trigged. Stop limit orders are similar, except the entered order is a limit order, not a market order. These guarantee you won’t sell below your limit, but you may be waiting forever if the asset is incapable of recovering.

In highly liquid markets, the market skipping over your stop loss and costing you dearly is less likely, but most asset classes have closing times. Unless you are trading cryptocurrencies, which are 24/7/365, most assets cannot be traded at any second (even FX is closed for 49 of the 168 hours of a week). This time can be very dangerous because devastating news can cause gap opens. Asset X was £218 at close on Friday, but by Monday morning, it may be £110, and no stop loss or stop limit order can protect you. Low volume stocks are even riskier because they can gap from order to order even when the market itself is open. Hence, if you have a lot of money in a specific investment, use hedging strategies that lock your price in (such as buying put options).

Side note: if an underlying stock is halted by the exchange, one can still exercise the option. Unfortunately, there is no way to accurately predict the price after the freeze is lifted. Exercising a put at $50 when the price halted at $60 might not make you any gains, since the price may restart trading at $55. If you don’t own the underlying at the time of exercise, you will be put into a short position. Notice that you go short at $50, but the market price is $55. You are already out $5.

The Folly of Thinking “This time it’s different”

One final warning: this time is probably no different. It is true that the world changes and sometimes certain changes do induce a new normal. But it is much more likely the asset is in a bubble, and wishful thinking does not change that fact. It may be detrimental to your portfolio. If the fundamentals do not align with the price, don’t assume the fundamentals are just lagging and will eventually catch up. They’re probably misaligned for a reason, and that reason is likely to be a bubble.

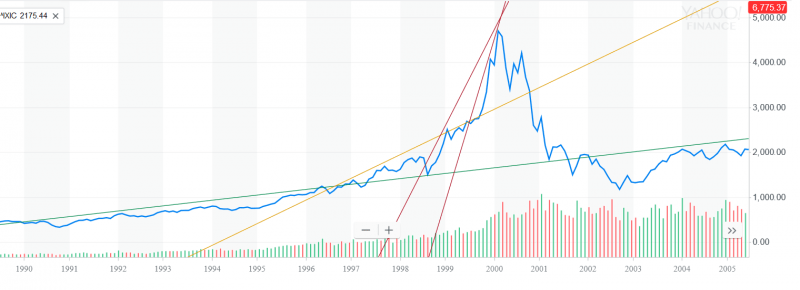

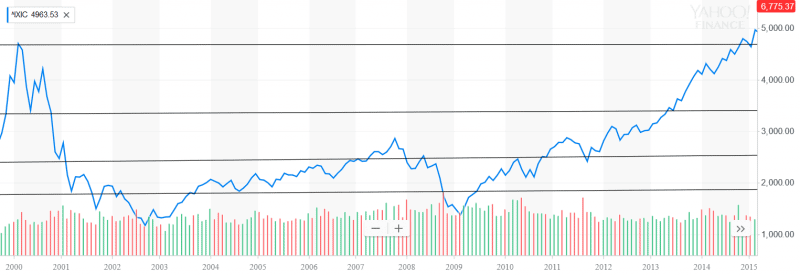

One of the most potent reminders is the Dot-Com bubble. The Internet is certainly revolutionary, and it has brought about massive changes. It is one of the most influential innovations in human history. The change in communications, networking, and technology was different this time. Ideas were true power, and having one could lead to hundreds of millions in revenue, even if at first the company burned through money. But did that justify the euphoric state of the market towards tech stocks in the late 1990s? A simple glance at the Nasdaq Composite chart below shows the folly in thinking “this time is different”. The price was stable, with modest gains, until the late 1990s (green and yellow lines). Then it started to race upward near the turn of the millennium (red lines) and subsequently crashed. The index didn’t recover for another 14 years.

Make no mistake, the Internet has produced new normals. There are new businesses that simply were not possible before the Internet, and they’ve made huge amounts of money. But the fundamentals of business haven’t changed: no revenue implies no reason for high valuations. While this time may be different in some aspects, do not neglect fundamental economics, which has not changed much since humans first started trading hundreds of thousands of years ago. Scammers also haven’t changed, and if it seems too good to be true, it probably is.

This chart also shows how “buying the dips” could lead to sustained losses. After the peak, there are 4 dips and small recoveries before the fifth downward trend reaches the trough. If you managed to buy at the bottom of the first dip, you would have to wait over a decade to become positive. This completely ignores over 10 years of inflation. The second dip would require six years to recover, and you would have to sell at a local peak. Missing that peak would mean another few years of waiting. If you were so unfortunate to buy at the peak in 2000, it would take nearly 15 years to just break even.

Conclusion

Some bubbles are so powerful, it is relatively safe riding the trend upward – just stay hedged in case the bubble bursts while you are long. Others are much weaker, and it can be dangerous to jump in. If the market psychology implies a longer uptrend, go with it. Being contrarian at the wrong time can result in substantial losses. Long-term contrarian views are also subject to profit erosion, as a continued restructuring of hedges, interest, or transaction fees swell.

If you think you’re late to the party, though, embrace your contrarian views. As long as the bubble bursts within a short period of time, contrarian plays can be very profitable.

If your risk appetite is low, better to stay on the sides, monitor the markets, and look for value once things start stabilising after a bubble burst. At CityFALCON, we help investors and traders track real-time and relevant financial news and content. Try it out here.

You can also track all real-time and personalised news (for you!) of all cryptocurrencies on CityFALCON here.

Leave a Reply