INTRODUCTION

You understand the need to invest your money, but don’t have the time, inclination or patience to read, understand and execute. Most of you would have at some point asked someone who you think is good at finance and investing to handle your money for you, but there has been no easy way to manage this, at least until now. Say hello to ‘social trading’. Now you could be sipping your favourite cocktail on a beach and your trades will mimic someone you’ve chosen to copy.

SOCIAL TRADING PLAFORM

eToro claims to be the world’s leading social investment network, and provides extensive tools for you to identify and ‘copy’ successful traders. You identify the traders you want to ‘copy’, allocate funds to those traders, and eToro will copy the exact trades that the trader executes for himself. And once you invest, you don’t have to do anything else because the entire process is automated. Simple!

You could also decide to just ‘follow’ rather than ‘copy’ a user. The difference is that in the case of ‘following’, you can see what he/she traded in, but you need to execute the transaction from your account manually. This is for those who want more control on where the money is invested.

eToro claims to have 3 million traders, and that about a million copy trades are performed each day.

IDENTIFYING TRADERS TO COPY

eToro provides you with tools to easily identify traders based on their returns over a period of time, number of profitable weeks, their risk profile and trading securities. Under the Discover People section, you could search for traders based on your risk-return profile. For example, you could say ‘I’m looking for people from United Kingdom who invest in Foreign Exchange, Stocks and Commodities, and gained at least 50% during the last year and didn’t lose more than 10% in any week during this period’. Voila – you’ll see a list of top traders. However, keep in mind that past performance is not an indication of future results, and hence it’s better to diversify by copying several traders.

You could see my profile here, but please refrain from copying me at this stage, as I prefer to actively invest myself instead of relying on other traders and using social trading.

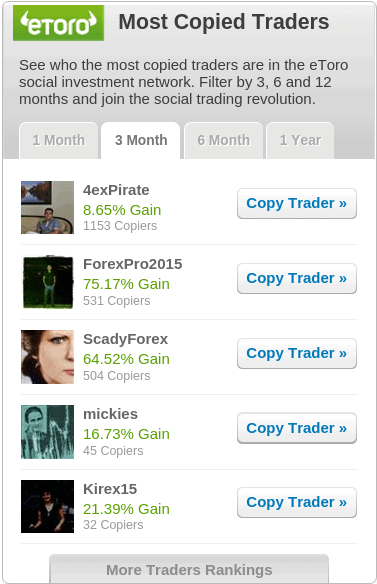

Below is an example list of most ‘followed’ traders and their returns over a period of time

CopyTrader is a product that may include CFDs.

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

WHAT’S IN IT FOR TRADERS?

Why would traders let you copy them? They get paid a monthly fee for every person who copies them and satisfies some criteria. Also, there is a leader board, and you know the competitive spirit in traders.

HOW TO GET STARTED

They have some cool videos here to get you started.

- Start small or use virtual currency: eToro allows you to use virtual currency to make sure you understand the functioning and limitations of the site before you start trading real money. Also, once you decide to use real money, minimum amount to invest is only $50 / £30.

- Diversify, diversify, diversify: I can’t stress enough the importance of this; just like you have to diversify your portfolio across asset classes, you should think about spreading your investments across at least 5 traders.

- Documentation: Make sure you complete all the documentation regarding residence, etc. before you start investing. This will avoid your money being stuck if there are any issues.

- Deposit – Withdrawal Cycle I’ve opened several broker accounts in the UK and deposited money into many of them; only once, I’ve had an issue with getting my deposit back. However, this has made me very cautious. For every new broker that I register with, I deposit a small amount, and try to withdraw a few days later to make sure there are no hurdles and fine print in getting my money back.

- If you still have any questions, please comment below this article, and I’d try and help you out.

THINGS TO WATCH OUT FOR

- Costs: There are no additional costs for copying traders at eToro , however their spreads or transaction costs for each trade are slightly higher than other brokers’ in the UK. You might want to compare these costs to other brokers, but the benefits of social trading tend to outweigh this incremental cost. Also, there are withdrawal processing charges, inactivity fees, etc. You could see the full list of costs here.

- Taxation: eToro offers Contract for Difference (CFD) for trading which may be taxable in your country.

- Traders Manipulating The Statistics: Since several of us look for “number of profitable weeks” to identify which traders to copy, several of these traders manipulate the system by not closing loss making trades. You can see how long trades have been kept open under the ‘Open Trades’ section. Staying away from dishonest people is always a good idea.

- Learning Curve Using The Platform: eToro’s web platform can be a bit overwhelming, and so, you may need to be patient and devote some time in understanding how it works. You could have a look at their training videos to get started.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

WANT MORE?

Leave a Reply