Disclaimer: This is a guest post from Michael Wiggins De Oliveira and Laurent M. Thibeault, and does not reflect the views of CityFALCON and its stakeholders.

FOSSIL (NASDAQ-GS:FOSL)

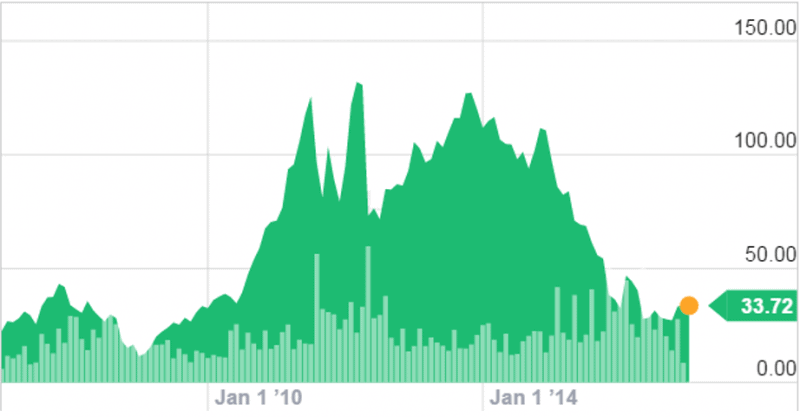

Current Price: $31

Target: $50-$55

Background:

If you haven’t heard of this company look around you. Chances are one or more people are wearing a watch from FOSL. The company sells around 30 million watches a year. In the past ten years FOSL has grown its revenue from c.$1.2bn to over $3bn. Today the company’s stock is trading cheaply- not only is there a degree of safety to be found on the balance sheet but, at current prices, the impressive growth track record comes at a reasonable price.

Business Overview:

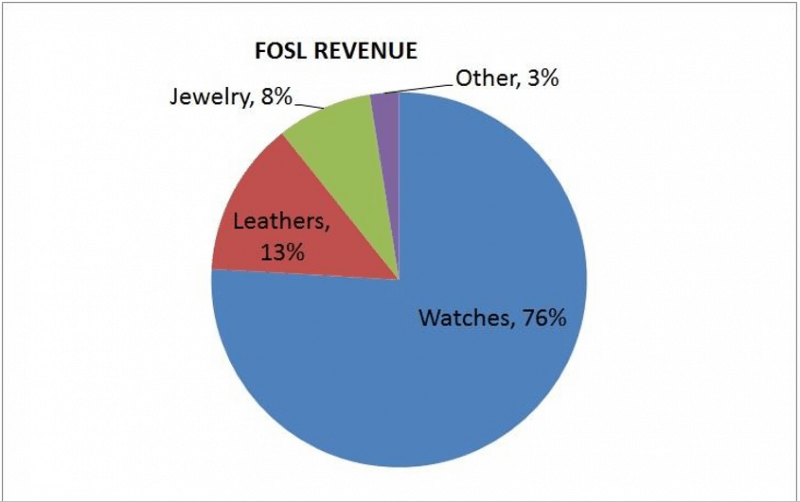

Fossil is a design, marketing and distribution company specialising in consumer fashion accessories, particularly watches. The company’s geographic segments are Americas, Europe and Asia.

This piece focuses primarily on FOSL’s watch sales, the mainstay of its business. Leather and jewellery are comparatively small segments. Similarly, though the company considers there to be growth opportunities in Asia there is limited discussion around growth in Asia in this article.

Headwinds

FOSL’s revenues peaked in its 2014 financial year at approximately $3.5bn. In the two consecutive financial years its revenue has declined to approximately $3.2bn (2015) and approximately $3bn forecasted for 2016.

FOSL appears to be suffering from the general brick-and-motor retail slump: lack of foot traffic in its stores with purchases moving online. Though the company boasts an omni-channel capability, it is behind the curve when faced with the so-called challenge from Amazon.

Furthermore, the arrival of the Apple iwatch in 2015 as well as a spate of other wearable technology offerings (e.g. Fitbit) represents a challenge to the traditional watch market.

Any growth company which hits a speedbump in its revenue expansion will likely suffer disproportionate falls in earnings. FOSL is no exception. Its net income dropped over 40% in 2015 and looks set to at least halve again for 2016.

Misfit Acquisition

In the face of these revenue headwinds, FOSL is not clinging to the past. In 2015 it acquired Misfit, a wearable technology company, for $236m. As FOSL stated in its annual report of that year, the primary purpose of the acquisition was to acquire a scalable technology platform that can be integrated across the Company’s multi-brand portfolio, a native wearable technology brand and a pipeline of innovative products. 2016 saw the planned integration and Fossil Q has been rolled out for holiday season as well as other brands in the FOSL universe such as the Armani brand, EA Connected. As FOSL goes into the holiday season, with both its legacy watch segment and its new wearables segment, this may be the start of a multiyear turnaround.

Financial summary

FOSL’s financials are attractive for an investor. FOSL has demonstrated an ability to generate consistent Free Cash Flow (FCF), with a normalized average FCF of c.$260m over the last five years. After all cash needed to be reinvested back into the business for maintenance and capex growth such a number is impressive. Furthermore this cash has funded its repurchases (highlighted in green below).

Valuation

FOSL is priced attractively relative to industry averages, the market and indeed its five year average.

Using a rough discount cash flow analysis based on:

$260m of FCF,

2% growth over the next five years (which is equal to normalized inflation, in other words 0% real growth in revenue), levelling off at 1%,

and a discount rate of 10%.

The 10% discount rate figure represents a conservative attempt to balance the riskiness of FOSL versus its revenue growth track record.

This back of the envelope valuation leads to an approximate value of $3bn, implying that this stock is well priced at its current market capitalisation of c. $1.7bn.

Competition

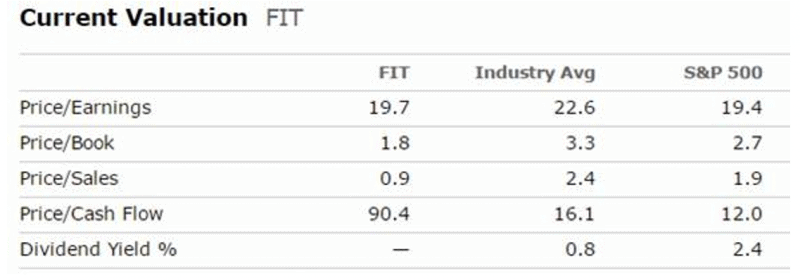

Given its new strategy it is apt to compare FOSL with Fitbit, Inc. (NYSE:FIT) in order to get a sense of its valuation versus a competitor. FIT is a market leader in wearables.

Shorts

Currently about 21% of FOSL’s stock is shorted. If the stock price performs and short sellers are forced to cover their positions, this could result in a further short-term boost to the share price.

Conclusion

Patient investors willing to wait 18 months for FOSL to implement its turnaround story could see the share price appreciate more than 50%.

Disclosure: I am/we are long FOSL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it.

If you’d like to track real-time relevant financial news for Fossil (NASDAQ-GS:FOSL), check it out here.

Leave a Reply