This post is inspired by the presentation by Kaushik Punjabi at London Value Investing Club. The content of the post however is the view of the author.

| Trading | Investing | |

| Purpose | Generate Short-Term Cash Flow | Develop and grow an asset portfolio over the longer term |

| Time Horizon | Short-Medium Term (Typically between 1 hour and a few months) |

Medium-Long Term (Typically between 1 month and many years) |

| Leverage | Yes – Very Frequently | Never or in a limited capacity |

| Timing | Critically Important | Less Important |

| Type of Play | e.g. Momentum Play | Research Drive/Investment Thesis |

| What do we analyze? | The stocks current trend is more important than underlying company | The company, not the stock itself |

| What do we do if stock declines? | Cut losses, sell shares immediately and start looking into the next trade | Potentially buy more? Re-evaluate research extensively before making decision to sell |

| PositioningLong/Short? | Long, Short, or a combination of both | Typically long, however there are exceptions |

| Human interaction with portfolio | Very high, lots of decision to be made | Less, fewer decision to be made |

| Famous sayings | “The trend is your friend until it ends” | Rule No 1 – don’t lose money; rule number 2 – don’t forget rule no 1 |

| Famous personalities | Jesse Livermoore, Paul Turdor Jones, George Soros | Warren Buffet, Peter Lynch, Monish Pabri |

While they may sound similar, trading and investing are in fact two very different strategies used to profit from financial markets. The choice of which strategy to employ often depends on the investor/trader themselves, and their personal financial goals, as both methods seek to generate the highest possible return; yet in very different ways.

At CityFALCON, we help newbies to investing get started in the stock markets. Give it a go here.

Investing – An Overview

The goal of investing is to gradually build wealth over an extended period of time through the buying and holding of a portfolio of stocks, ETFs, mutual funds, bonds and other investment instruments. Investing is about growing your portfolio of assets in the medium to long term, with little regard for short-term market fluctuations.

This differs from trading in that, while a trader may sell a losing stock immediately to ‘cut his/her losses,’ the investor would have conducted substantial research regarding the long-term performance of the underlying company, and would hold the losing stock, aware that according to their research it would rebound in the longer-term.

Investing – The Decision-Making Process

When an investor is considering an investment in an asset, he/she will generally begin by researching the underlying company, looking at their past and projected financial performance to try and determine the growth prospects of the stock in the medium-long term. The investor will generally disregard the stock charts, as these are reflections of short-term volatility, and are more useful to technical traders. Whereas the trader may be influenced to purchase a stock simply because of a positive news article, the investor conducts extensive company/macroeconomic research over weeks to get a good understanding of the company, its operating environment and growth prospects; because he/she intends to hold the stock for a much longer period of time than the trader.

Investing – Financial Goals

The financial goals of the investor are long-term, and generally involve growing the asset portfolio as large as possible, with less regard for immediate cash flow. An investor is less concerned about when he/she will have access to their money, and more about which asset class provides the absolute highest return over the long-term. A trader, on the other hand, is looking to earn the highest return within a short period of time, and therefore will be more inclined to trade with stocks, ignoring other longer-term asset classes which tie-up cash flows for long periods of time.

Trading – An Overview

The goal of trading is similar to investing in that traders try to achieve the highest return. However, a trader usually has an investment time horizon of < 1 month, and therefore is only concerned about generating as much cash flow as possible within a short period of time. The concept of a portfolio for a trader is very different, as where an investor may hold the same 5 assets within his/her portfolio for 5 years, a trader is likely to have traded 50+ securities within that same portfolio through the same time period. This high asset-turnover for traders implies that they have a different asset-selection process, designed to find assets poised for immediate growth which can be disposed of in less than a month.

Trading – The Decision-Making Process

With traders, the goal is to find assets poised for immediate growth, not long-term growth. Therefore, a trader would be happy investing in a stock, even if it only provided one day’s worth of appreciation (perhaps because of a positive news article,) since he/she would be able to dump that stock the same day and walk away with modest returns. Once common method of ‘asset-picking’ for traders is through a method of analysis called ‘technical trading.’ This form of trading involves analyzing the price charts of stocks, in order to look for certain trend lines and patterns which may indicate future price movements.

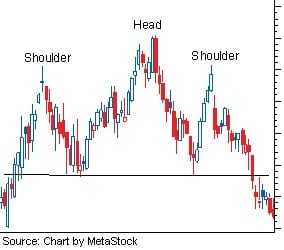

For example: a trader may look at the price chart for Company A, and notice a ‘head-and-shoulders’ pattern, a common price pattern in stock charts which can be used to predict future price spikes and collapses. The graphic below depicts the typical ‘head-and-shoulders’ formation in a stock price chart.

Trading – Financial Goals

As mentioned above, the financial goals of a trader involve generating as much cash flow as possible in the shortest amount of time, playing short term equity volatility to earn capital gains. Traders are much less concerned with the underlying fundamentals of the company, as short term volatility is typically a product of group behavioural mentality and current corporate news items. Therefore, rather than looking at companies with strong financials and management, a trader would analyze the news for a company with recent positive developments. Traders might also look at which companies are releasing earnings in the upcoming weeks, making estimates on which companies will exceed analyst consensus and purchasing those shares in anticipation of the future spike upon the earnings release.

Conclusion

Despite the terms often being used interchangeably, trading and investing are entirely different methods of generating profit from financial markets, and the choice of which strategy to use depends on personal beliefs, financial goals and analytical methods. Investors tend to focus on the long-term growth of their asset base, while traders prefer to generate as much cash flow in the short-term as possible. Before setting out on your investing journey, you must define which type of trader/investor you are, as there are many different ways to earn a living through financial markets.

Leave a Reply